The Single Strategy To Use For Card Processing

Table of ContentsPayment Processor for DummiesNot known Details About Ecommerce Payment Checkup Can Be Fun For EveryoneSome Known Facts About Payment Solutions.Ecommerce Fundamentals ExplainedLittle Known Questions About Payment Solutions.Getting The Merchant Account To Work

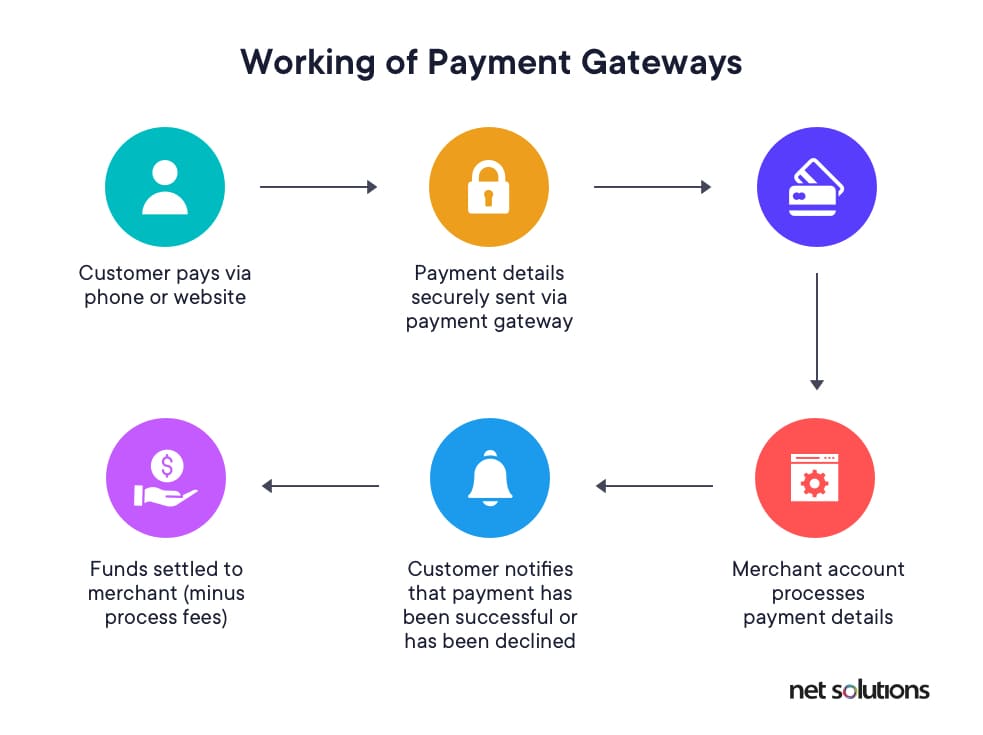

Transaction standing is returned to the repayment gateway, after that passed to the site. A consumer receives a message with the purchase standing (accepted or denied) using a settlement system user interface. Within a pair of days (generally the next day), the funds are transferred to the vendor's account. The deal is done by the providing financial institution to the getting bank.

Now we are moving closer to payment gateways in their range. To incorporate a settlement system right into your website, you will need to adhere to numerous steps. Payment entrance integration Usually, there are 4 major approaches to integrate a repayment gateway. Every one of them differ by 2 major variables: whether you have to remain in compliance with any type of monetary regulation (PCI DSS), and also the level of customer experience worrying the check out and also repayment procedure.

Getting My Payment Solutions To Work

What is PCI DSS conformity and when do you need it? In situation you just require a payment gateway solution and also don't prepare to shop or procedure charge card information, you might avoid this section, due to the fact that all the processing and also regulatory burden will be performed by your gateway or settlement provider.

is an essential component for processing card repayments. This protection criterion was produced in 2004 by the four most significant card organizations: Visa, Master, Card, American Express, and also Discover. To come to be PCI compliant, you will have to complete 5 steps:. There are 4 levels of conformity that are determined by the variety of risk-free deals your company has actually ended up.

SAQ is a collection of requirements and also sub-requirements. The current variation has 12 requirements. AOC is a sort of examination you take after reviewing the requirements. There are 9 sorts of AOC for various services. The one required for merchants is called AOC SAQ D Merchants. The listing of ASVs can be located right here.

The 15-Second Trick For Payment Solution

Provided this details, we're going to take a look at the existing combination alternatives as well as describe the advantages and disadvantages of each. We'll also concentrate on whether you should adhere to PCI DSS in each case as we discuss what assimilation approaches suit various kinds of services. Held portal An organized settlement portal works as a 3rd party.

Generally, that holds true when a consumer is redirected to a payment portal website to key in their bank card number. When the deal data is sent out, the client is rerouted back to the merchant's web page. Below they wrap up the checkout where purchase authorization is revealed. Held settlement gateway work system of a hosted settlement gateway are that all settlement handling is taken by the service carrier.

Using a hosted portal needs no PCI conformity and also uses quite easy integration. are that there is an absence of control over a hosted gateway. Clients might not trust third-party settlement systems. Besides that, rerouting them away from your site reduces conversion rate and does not aid your branding either.

What Does Online Payment Systems Do?

Essentially, it's a piece of HTML code that implements a Pay, Buddy click for info button on your check out page.

Direct Article method Direct Article is an assimilation technique that permits a customer to shop without leaving your web site, as you don't have to get PCI compliance. Straight Post thinks that the transaction's information will be posted to the repayment portal after a customer clicks a "purchase" switch. The data quickly obtains to the entrance and also cpu without being kept rd party credit card processing by yourself server - online payment systems.

Card Processing Can Be Fun For Anyone

Below are some things to take into consideration before deciding on a service provider. Research the pricing Repayment handling is intricate, as it includes a number of banks or companies. Like any type of solution, a settlement portal needs a cost for using third-party devices to process as well as license the purchase. Every party that takes part in repayment verification/authorization or handling charges fees.

Every repayment service carrier has its own terms of usage and costs. Usually, you will certainly have the adhering to fee types: gateway arrangement charge, month-to-month entrance fee, vendor account arrangement, as well as a fee for each transaction processed.

6 Easy Facts About Merchant Account Shown

This is primarily a prebuilt entrance that can be tailored and branded as your very own. Here are some widely known white label solutions made for vendors: An incorporated portal can be a specialized resource of earnings, as merchants that obtain all the necessary conformity become settlement service carriers themselves. This suggests your service can refine repayments for other vendors for a charge.

are that you have complete control over the transactions at your internet site. You can personalize your payment system as you desire, guardian financial credit card processing as well as tailor it to your service requirements. In case of a white-label option, the repayment entrance is your branded innovation. typically are everything about preserving the facilities of your settlement system as well as the related expenditures.

Right here are some things to consider prior to selecting a supplier. Study the rates Payment processing is intricate, as it consists of a number of banks or companies. Like any service, a settlement entrance requires a fee for using third-party devices to procedure and accredit the deal. Every party that takes part in payment verification/authorization or handling charges costs.

Payment Processing for Beginners

Every repayment remedy carrier has its own regards to usage and charges. Usually, you will have the following cost types: entrance configuration cost, month-to-month portal charge, vendor account configuration, as well as a cost for every deal processed. Check out all the prices paperwork to avoid hidden fees or added expenditures. Examine purchase limitations for a provided service provider While charges and installation fees are unpreventable, there is something that may figure out whether you can deal with a certain carrier.